State Bank of India (SBI) has reviewed the requirement of maintaining Monthly Average Balance (MAB) and the charges for non-maintenance of MAB. In this context SBI would like to state that financial inclusion including JAN DHAN Accounts have never been subject to any charges. In respect of the rest, it has now been decided to exempt the pensioners, beneficiaries of social benefits from the Government and accounts of Minors. Therefore, this is in addition to the already exempted categories under PMJDY accounts and Basic Savings Bank Deposits Accounts (BSBD).

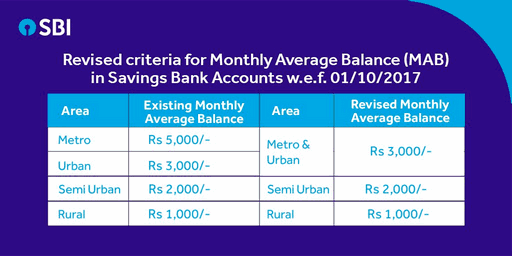

SBI Lowers Minimum Account Balance Requirement to Rs 3,000

The Bank has also decided to treat the metro and urban centres in the same category and the requirement of MAB in metro centres stands reduced to Rs.3000/- . For non-maintenance of MAB, the charges have also been revised downward ranging from 20% to 50% across all population groups and categories. The charges at semi-urban and rural centres range from Rs.20/- to Rs 40/- and at urban and metro centres from Rs 30/- to Rs 50/-. The revised MAB requirement and charges will become applicable from the month of October 2017, i.e., with effect from 01-October-2017.

More Information on SBI Reduces Minimum Balance Limit

The Bank has a very strong deposit franchise having 42 crores Savings Bank accounts out of which 13 crore accounts under PMJDY / BSBD were already exempted. The above revision is likely to benefit another 5 crore account holders. The Bank also clarified that customer always has the option of converting the regular savings bank account to BSBD account, free of charge, in case he desires to avail basic savings bank facilities without being subject to maintain MAB. The features of BSBD accounts are available in the bank’s website bank.sbi.

The following categories of Savings Bank Accounts are excluded from MAB requirement:

- Financial Inclusion Accounts

- No frill accounts

- Salary Package accounts

- Basic Savings Bank Deposit Accounts

- Small Accounts

- Pehla Kadam and Pehli Udaan accounts.

- Minors up to the age group of 18 (Primary Account Holder) viii) Pensioners, all categories, including recipients of social welfare benefits

About State Bank of India : the Banker to Every Indian

State Bank of India (SBI) the largest commercial bank in India in terms of assets, deposits, profits, branches, customers and employees. The bank has a deposit base of 26.02 lakh crore with CASA ratio of 43.81%. As on June 30, 2017, SBI has an extensive network, with over 23 thousand branches in India and 194 offices in 35 other countries across the world in all time zones. It has a strong network of more than 59 thousand group ATMs. With more than 2.73 lac employees it caters to a customer base of more than 42 crore which includes nearly 2.3 crore Mobile Banking users, over 4 crore Internet Banking users, 1.07 crore State Bank Buddy users. As on March 31, 2017, the bank has installed more than 6 lac PoS terminals, capturing a little over 22% of market share and 34.5 crore State Bank Debit Card holders. SBI has the highest number of Facebook followers across all banks in the world. SBI's non- banking subsidiaries / joint ventures are market leaders in their respective areas and provide wide ranging services, which include investment banking, life insurance, general insurance, mutual funds, credit cards, factoring services, security trading, etc making the SBI Group a truly large financial supermarket and India's financial icon.

Source Link:

www.facebook.com/notes/state-bank-of-india/sbi-revises-service-charges-on-maintaining-monthly-average-balance/1618212918229500/

www.facebook.com/notes/state-bank-of-india/sbi-revises-service-charges-on-maintaining-monthly-average-balance/1618212918229500/

Since, there was a huge cry in general public over the previous SBI’s move that from 1st April 2017 it will be penalizing those savings account holders who do not maintain the Monthly Average balance or MAB. Hence, SBI has taken this step to reduced minium monthly balance requirement for its accountholders.

If you want to share your view / comment / suggestion / experience on “Minimum Balance Requirement” of State Bank acoountholders then do not hesitate to share that through the comments box provided below.

If you want to share your view / comment / suggestion / experience on “Minimum Balance Requirement” of State Bank acoountholders then do not hesitate to share that through the comments box provided below.

Related Posts:

Next Post:

Previous Post:

SBI Accountholders Could Get Personal Accidental Insurance of Rupees 4 Lakhs

Quick Ticket Booking Online using IRCTC e-Wallet Payment Scheme

Employee Provident Fund Balance with EPFO e-Passbook Online using members.epfoservices.in

EMS Speed Post | Express Parcel Movement | Delivery Status | Track Article Online

Recharging Mobile TopUp Online through Online SBI-OxiPay (via Oxygen)

Book Tatkal/eTickets at IRCTC’s Next Generation e-Ticketing site, the fastest ever IRCTC Website : https://nget.irctc.co.in/

IRCTC implemented Steps to Streamline Tatkal Ticket Booking for Rail Passengers

Instant Money Transfer from SBI ATM | Debit Card to Card | State Bank Cash Transfer

Next Post:

Get BSNL High Speed Unlimited Broadband for Monthly Rs 249 Only”

Previous Post:

Jio Users Can Now Track 4G Data Balance for the Day by SMS

Jio Users Can Now Track 4G Data Balance for the Day by SMS

{ 0 comments... read them below if any or add comment }

Post a Comment